Back

3 Aug 2021

Crude Oil Futures: Further decline not favoured

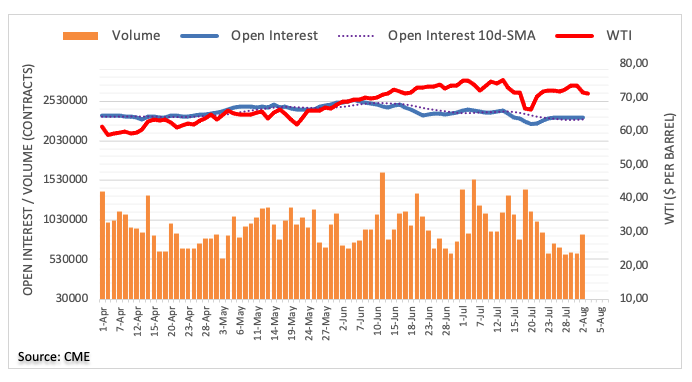

Open interest in crude oil futures markets went down by nearly 3K contracts at the beginning of the week, partially reversing the previous build, considering preliminary figures from CME Group. On the other hand, volume extended the choppy activity and rose by around 245K contracts, the largest single day build since July 19.

WTI faces extra gains above $74.00

Prices of the WTI started the week on a negative footing, receding to the $71.00 area. The downtick was amidst shrinking open interest, however, hinting at the view that a deeper pullback is somewhat not favoured in the very near term at least. On the upside, prices need to surpass recent tops around $74.00 to allow for further gains.