EUR/USD sinks to weekly lows near 1.1380 on US CPI

- EUR/USD reverses the initial optimism and breaches 1.1400.

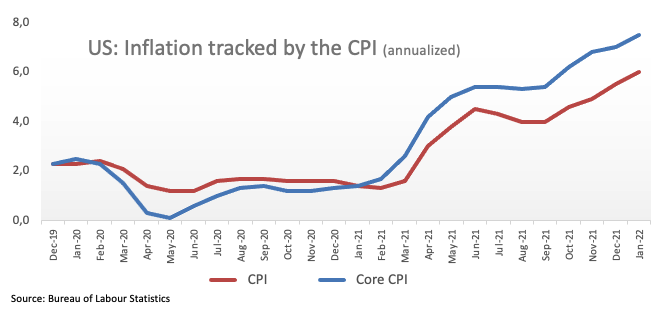

- US CPI rose 7.5% YoY in January. Core CPI gained 6.0% YoY.

- US Initial Claims rose by 223K in the week to February 5.

The sudden bout of strength in the greenback forced EUR/USD to give away earlier gains and break below the 1.1400 support on Thursday.

EUR/USD weaker post-US CPI

EUR/USD drops to new multi-session lows after US inflation figures tracked by the CPI surprised to the upside in January, showing consumer prices rose 7.5% from a year earlier while prices excluding food and energy costs rose 6.0% also on a yearly basis.

The higher-than-expected US CPI gave extra wings to the buck and US yields and reinforce further the speculation of a more aggressive lift-off by the Fed at the March meeting.

Extra results from the US docket also saw weekly Claims bettering estimates after rising 223K in the week to February 5.

EUR/USD levels to watch

So far, spot is losing 0.12% at 1.1407 and faces the next up barrier at 1.1483 (2022 high Feb.4) followed by 1.1496 (200-week SMA) and finally 1.1664 (200-day SMA). On the other hand, a break below 1.1381 (weekly low Feb.10) would target 1.1323 (55-day SMA) en route to 1.1121 (2022 low Jan.28).